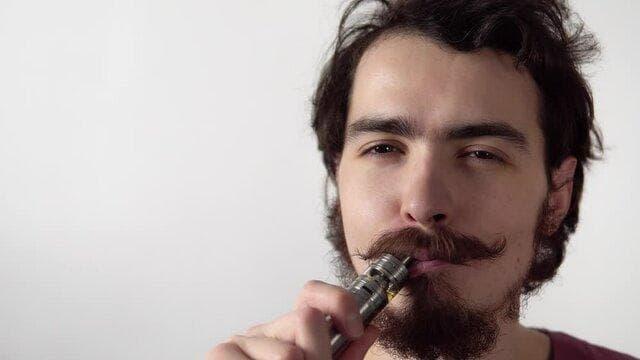

Practical Guide: Sourcing IBVAPE E-Cigi and Understanding dominican republic e-cigarette import rules for 2025

This comprehensive buyer’s and compliance handbook is designed for retailers, wholesalers, importers and informed consumers who want to source quality devices while complying with local law. The focus is on best-practice procurement of IBVAPE E-Cigi|dominican republic e-cigarette import rules related matters: product selection, documentation, customs expectations and practical logistics. Throughout this resource you’ll see clear steps, compliance checklists and procurement tips that reduce risk and improve margins.

Why combine product tips with regulatory clarity?

Buying a popular brand like IBVAPE E-Cigi is only half the equation. Import success in the Dominican Republic depends on understanding product classifications, labelling norms, permissible nicotine levels, taxes, harmonized system (HS) codes and documentation needed at customs. This guide interweaves shopping advice with a targeted compliance checklist for dominican republic e-cigarette import rules, helping you to avoid delays, fines or seizure.

Quick glossary and search-friendly terms

- IBVAPE E-Cigi: A consumer e-cigarette/e-nicotine device brand that you may source internationally.

- dominican republic e-cigarette import rules: The set of customs, health ministry and tax regulations governing importation and sale of vaping products in the Dominican Republic.

- HS code: Harmonized System Code for customs classification.

How to choose the right IBVAPE device (product selection checklist)

Whether you are sourcing single-use vapes, refillable pod systems or modular kits, start with a clear procurement specification. Below is an itemized checklist to ensure product quality and compliance readiness.

- Model and SKU mapping: Maintain a master list of SKUs, model numbers and batch numbers for every IBVAPE E-Cigi item. Use consistent naming to match invoices and packing lists.

- Ingredients and nicotine concentration: Obtain full ingredient lists and lab reports for nicotine concentration, emitted substances and e-liquid composition. Dominican regulators look for clear nicotine labels and restricted substances list.

- Battery and safety certifications: For devices with lithium batteries, require UN38.3 test summaries and transport-compliant documentation. Ask suppliers for CE, RoHS or similar safety attestations if available.

- Packaging and labelling: Insist on compliance-ready labels: Spanish translations, health warnings, nicotine strength in mg/ml and net content. Avoid vague labels — they trigger customs holds.

- Child-resistant and tamper-evident features: Devices and e-liquid containers that are not child-resistant can be non-compliant. Document protective features in your supplier contract.

- Batch traceability: Keep supplier batch records, QC reports and production dates to support any recall procedures.

Supplier due diligence

Vet prospective IBVAPE suppliers for factory audits, product liability insurance and transparent lead times. Ask for references from other Caribbean or Latin American importers. Build an onboarding packet that includes a supplier declaration specifying the composition, origin and HS code of products.

Key legal and customs considerations for dominican republic e-cigarette import rules

Customs and health authorities in the Dominican Republic enforce rules that affect clearances, duties and the ultimate ability to market products. This section summarizes core rules importers routinely handle. Always consult local counsel for final interpretations.

Classification and HS codes

Assign the correct HS code to each product. E-cigarettes, cartridges and e-liquids may fall into different subheadings. An inaccurate HS code can produce incorrect duty assessments or trigger inspections. Include the HS code on commercial invoices and packing lists to expedite processing.

Permitted nicotine levels and labelling language

Authorities pay attention to nicotine concentration caps and mandated warning language. Ensure labels display nicotine strength in mg/ml and include health warnings in Spanish. Use clear, non-misleading marketing claims: do not state product cures or treats medical conditions, as that may reclassify the product as a medicinal article.

Documentation required for smooth customs clearance

- Commercial invoice with detailed product description and HS code

- Packing list with SKU-level breakdown and gross/net weight

- Bill of lading or airway bill

- Certificate of origin (when preferential tariff or free trade benefits are claimed)

- Safety Data Sheet (SDS) for liquids containing nicotine

- Battery UN test documentation, if applicable

- Supplier declaration of compliance including lab test summaries

Tip: Pre-file with the local customs broker

Work with a licensed customs broker in the Dominican Republic to pre-file documents. Pre-clearing reduces hold-ups and gives you a realistic estimate of duties and taxes.

Taxes, duties and financial planning

Import duties and special taxes (sin taxes) can substantially increase landed cost. When calculating landed cost for an IBVAPE E-Cigi|dominican republic e-cigarette import rules shipment, include:

- Customs duty (based on CIF/FOB valuation and HS code)

- Value-added tax (VAT) or sales tax on importation

- Any excise/special consumption tax applied to nicotine products

- Brokerage fees, storage costs and inspection fees

Get early cost estimates from your broker so you can set competitive retail pricing without eroding margins.

Logistics: packaging, shipping and hazards management

Logistics require special focus when shipping devices with batteries and nicotine liquids. Packaging should conform to international air and sea transport rules to avoid refusal by carriers:

- Mark boxes with UN handling marks if shipping lithium batteries; segregate battery shipments where required.

- Package e-liquids to prevent leakage — inner sealing, bagging and absorbent material are standard.

- Label dangerous goods when applicable and include emergency contact details.

Use insured carriers experienced with regulated consumer goods and e-cigarette consignments destined for the Caribbean market.

Retail readiness: labeling, marketing and point-of-sale checks

Before placing products on shelves, confirm that packaging is consumer-ready under local rules: Spanish health warnings, accurate nicotine disclosure, no youth-oriented marketing, and age restriction statements. Keep marketing copy conservative and compliant: avoid medical claims and do not promote products as cessation devices unless they are approved by health authorities.

Age control and verification

Implement clear age verification procedures at point of sale and for online purchases. Maintain records of compliance efforts to demonstrate due diligence in the event of inspections.

Quality control and testing

Adopt a sampling and testing protocol for every inbound lot. Key lab tests to request from suppliers or from third-party labs include:

- Nicotine concentration confirmation

- Contaminants (heavy metals, carbonyls when applicable)

- Battery safety and charge/discharge tests

- Emissions testing for aerosols (if available)

Retain certificates and chain-of-custody documents; customs and health regulators may request them during routine checks.

Customs interaction scenarios and escalation steps

If customs places a shipment on hold, follow these steps:

- Request a written cause for detention from the customs authority.

- Provide supporting documentation promptly: invoices, lab reports, SDS, COO and supplier declarations.

- Engage your broker to request reclassification or to appeal administrative findings if the detention is due to incorrect HS codes.

- If needed, retain a local customs consultant or attorney to liaise with authorities.

Common causes of delays

- Incomplete invoices lacking HS codes or accurate product descriptions

- Packaging that conflicts with labelling laws (e.g., English-only warnings)

- Missing SDS or UN battery documentation

- Claims or advertising language that reclassifies product as medicinal

Practical procurement strategies to reduce compliance friction

Implement the following operational controls when ordering IBVAPE E-Cigi goods:

- Standardized supplier packet: require suppliers to complete a compliance checklist that mirrors Dominican requirements.

- Sample-first policy: always request a sealed sample from the exact production batch before mass ordering.

- Consolidation best practice: consolidate small orders to reduce per-shipment customs fees but ensure you do not exceed storage or tax thresholds that trigger additional taxation.

- Local warehousing: using bonded warehouses can defer certain taxes until goods are released for the Dominican market.

Contracts, warranties and returns

Negotiate clear warranty and returns policies with suppliers to cover defective batches, lab non-conformance and incorrect labelling that may cause tax or regulatory penalties. Require the supplier to indemnify you for customs fines arising from inaccurate product descriptions or omitted documentation.

Record-keeping and compliance logs

Maintain an electronic compliance folder per SKU with invoices, certificates, lab reports, shipping docs and correspondence. Good record-keeping saves time during audits and speeds resolution of any questions from regulatory bodies.

Suggested file types to store

- PDF commercial invoices and packing lists

- Signed supplier declarations and COOs

- Third-party lab certificates

- Shipping and tracking confirmations

- Customs entry documents and paid tax receipts

Risk management and insurance

Procure marine cargo insurance with coverage for customs-related delays and declared value protection. Investigate product liability insurance that covers the Dominican Republic market specifically — regional limitations often apply.

Sample template: import document checklist

Below is a condensed import-ready checklist you can copy into your procurement system and adapt per shipment:

- Commercial Invoice: SKU descriptions, HS codes, FOB/CIF values.

- Packing List: Unit counts, net/gross weight, dimensions.

- Bill of Lading / AWB: Carrier, voyage/flight, ETA.

- Certificate of Origin: If claiming preferential tariff treatment.

- Supplier Declaration of Ingredients and Nicotine Concentration.

- Safety Data Sheet (SDS) for e-liquid and batteries.

- Battery UN Test Certificates (if relevant).

- Third-party lab test for nicotine concentration and contaminants.

- Proof of tax payment or bond (if pre-paid).

Common mistakes and how to avoid them

New importers often make predictable errors:

- Under-declaring value to reduce duties — this risks fines and seizure.

- Using ambiguous product descriptions like “electronic device” instead of “electronic nicotine delivery system” with clear nicotine strengths.

- Shipping batteries without UN documentation.

- Neglecting Spanish-language labeling requirements.

Retailer tips: merchandising and compliance-friendly marketing

Stock rotation is important: avoid selling outdated or improperly labelled batches. Train staff to verify labels and to record age verification checks. In-store POS materials should include explicit warnings and contact details for consumer complaints.

Checklist for first-time importers

Before you place your first order, confirm the following:

- You have a licensed customs broker in the Dominican Republic.

- You possess or have access to lab certificates and SDS for every product.

- Your packaging includes Spanish warnings and nicotine concentrations.

- Your financial model includes duties, taxes, brokerage, and insurance.

- You have contingency capital for potential customs holds or re-export costs.

Advanced topics: regulatory trends and proactive compliance

Regulation for vaping products evolves quickly across the Americas. Monitor multiple sources: the Dominican Ministry of Public Health, the customs tariff updates and regional trade agreements. Subscribe to alerts and work with a local legal advisor to maintain a compliance roadmap for your product portfolio. Consider product reformulation or alternative packaging to meet future restrictions, such as flavour bans or stricter nicotine caps.

Data-driven inventory strategies

Use sales and compliance data to optimize assortment — high-risk SKUs that often trigger inspections may require additional controls or may be better excluded.

Useful tags and SEO optimization notes for site publishing

When publishing content about IBVAPE E-Cigi|dominican republic e-cigarette import rules on a commercial site, follow these content optimization tips:

- Use the exact keyword phrase occasionally in headings (as we have) and naturally in body copy.

- Wrap primary phrases in or tags for emphasis and semantic weight.

- Use structured headings (H2, H3, H4) to break content and improve crawlability.

- Include an FAQ block where appropriate to capture long-tail search queries and rich result opportunities.

Practical next steps

To move from learning to action, create a one-page import plan per SKU and schedule a supplier audit. Confirm lead times and sample testing timelines — lab verification often takes weeks and should be factored into ordering cycles. Update your import plan every time a regulation or tariff change is announced.

Smart importers combine product knowledge with regulatory awareness — the least risky shipments are those planned with both in mind.

Local partnerships and resources

Build relationships with local partners: a licensed customs broker, a health-regulatory consultant and a bonded warehouse operator can speed market entry and minimize risk. Join local trade associations to stay informed about changes to dominican republic e-cigarette import rules.

Vendor negotiation tips

Negotiate clauses requiring timely replacement for non-compliant batches and specify documentation turn-around times. A vendor who resists sharing SDS or lab reports is a red flag.

Appendix: sample supplier declaration language

Request simple, signed declarations from suppliers stating: “The products described herein are free from prohibited substances, contain the declared nicotine concentrations, and the manufacturer attests to the accuracy of batch information provided.” Store signed declarations with your import records.

Template clause for contracts

“Supplier shall indemnify and hold harmless importer for fines, losses or costs arising directly from inaccurate product descriptions, missing labelling or omitted safety documentation necessary for lawful import into the Dominican Republic.”

Final practical reminders

Consistency is the most important compliance tool: consistent documentation, consistent labelling and consistent product testing. If you systematize compliance into procurement and inventory operations, you will reduce surprises and build a predictable business around IBVAPE E-Cigi|dominican republic e-cigarette import rules trade.

FAQ

Q: Do I need a special license to import e-cigarettes into the Dominican Republic?

A: Licensing requirements change; at minimum you need a registered importer identity, a customs broker and all product documentation. Check with the Ministry of Public Health and a licensed customs broker for current licensing obligations.

Q: What documentation most often causes customs delays?

A: Missing or vague commercial invoices (without HS codes), absent SDS and lack of lab testing reports for nicotine concentration are the most common causes of detention.

Q: How should I label nicotine strength for Dominican consumers?

A: Use clear nicotine concentration in mg/ml on packaging, and include mandatory Spanish-language health warnings as required by local laws. Avoid medical claims or implied health benefits.

By following the steps and checklists above, you will be better prepared to source IBVAPE E-Cigi products and to handle the legal and logistical realities of dominican republic e-cigarette import rules. Implement the templates, keep thorough documentation, and work with trusted local experts to safeguard shipments and accelerate market entry.